Lending Examples

$150,000

Capital needed urgently during government shutdown to open spa franchise. Client unable to obtain desired SBA funds due to shutdown.

GLFC’s Solution:

Personal Loan

Short Term Loan

Sometimes speed is everything. No matter how much planning you do, small business ownership is full of surprises. Thinking on your feet and coming up with quick solutions is often the difference between shutting your doors and shutting out the competition. A short term loan can get you financing in as little as 24 hours.

Loan Amount: $2,500 – $500,000

Time to Funds: As soon as 24 hours

Interest Rate: As low as 8%

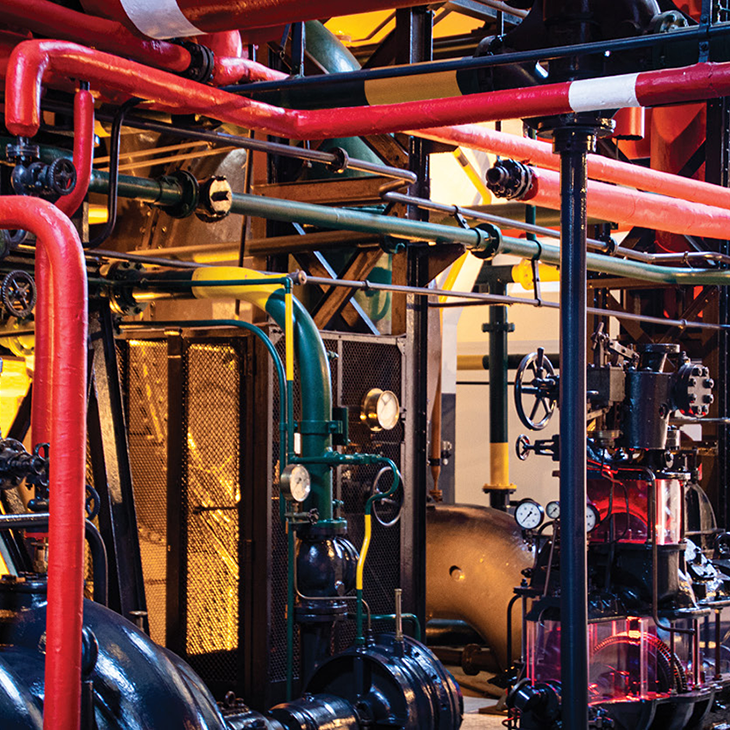

Equipment Loans

Loan Term: 1 – 5 Years

Time to Funds: As fast as 24 hours

Interest Rate As low as 7.5%

$3+ Million

Capital for industrial cleaning company to meet their working capital, payroll, and accounds receivable financing needs.

Problem:

Bank Called the original loan

GFLC’s Solution:

Line of Credit & Receivables Financing

$51,201

Capital needed quickly for specialized agricultural equipment purchase to fulfill over $500K in commercial contracts. Bank loan process estimated to take 45-60 days.

GLFC’s Solution:

Loan Funded in 8 Business Days

$1 Million

Capital for payroll and accounts receivable financing for healthcare company.

Problem:

Bank called the original loan